Momentum Investing

Momentum, in the context of securities trading, refers to the rate of acceleration of a security's price. This metric is used to gauge the speed at which a security's price changes over a given period. The momentum trading strategy is an investment approach that seeks to capitalize on this phenomenon by entering a trend as it begins to gain momentum. This strategy is predicated on the belief that a trend, whether upward or downward, tends to persist for a certain period of time and takes into account both price and volume data to identify and confirm the trend. In technical analysis, momentum is often measured through oscillators, which are statistical indicators used to identify trends and patterns in financial data.

Momentum in investing refers to the continuous uptrend or downtrend in the value of securities, such as stocks, reflecting their current market trend. Momentum investing is a strategy that seeks to capitalize on this phenomenon by investing in assets that have shown strong momentum in the recent past, with the expectation that they will continue to perform well in the future. Historically, momentum strategies have been shown through research to have the potential to generate excess returns. Investors who want a well-diversified portfolio may consider gaining exposure to the momentum factor.

Momentum investing can be implemented by selecting companies with rising share prices, increasing revenue, and strong fundamentals for equities while using only technical indicators for other securities. Momentum ETFs can utilize both long and short positions, investing in stocks with positive momentum while short-selling those with negative momentum, marked by declining share prices and weakening financial performance. By combining both long and short positions, momentum ETFs can benefit from both upward and downward movements in the market. This strategy can be implemented using exchange-traded funds (ETFs) that track momentum-based indexes such as the S&P 500 Momentum Index.

In general, momentum investing tends to perform well during periods of stable macroeconomic conditions and a long bull market, but it can also be subject to significant underperformance during market recessions and other extreme market conditions. Over the last 10 years, the S&P 500 Momentum Index has outperformed the S&P 500 by 1.39% on an average annualized basis, while the VIX has stayed relatively calm.

During higher volatility periods, momentum investing underperforms because of the higher risk external events pose to a company’s performance. A momentum factor investor benefits from a smooth economy as any changes could ‘rock the ship’ and hinder companies’ ability to continue to outperform.

Recent Performance

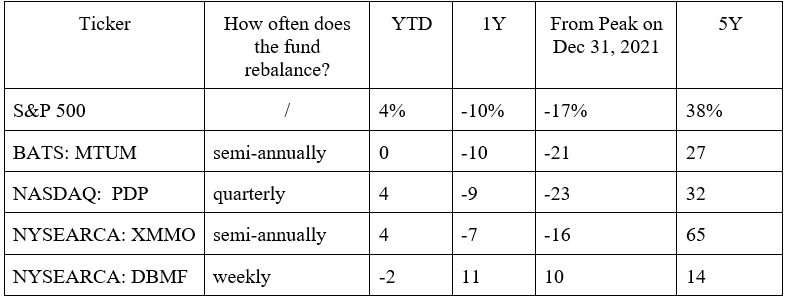

In a practical sense, however, momentum trading ETFs should outperform in times of higher volatility because it thrives off movement up or down. So, why else does it underperform in reality? In examining the three largest momentum trading ETFs, one can see that the results are no better than the market.

Selected Momentum Trading ETFs Performance on January 23rd, 2023

All figures are rounded to the nearest percent. Calculations done by author.

MTUM and PDP are long-only US ETFs that focus on large-cap stocks. By focusing on these large-cap stocks, the funds are not sufficiently differentiated from the market. Also, there will tend to be a considerable amount of overlap between the top holdings of these ETFs and the largest stocks in the index, an example being Apple. These funds use their proprietary algorithm to pick US stocks with certain momentum factors, but these groups of stocks have been performing similarly to the whole market. This fact would imply that these ETFs are essentially buying a smaller sample size of the broader market, and the results end up being the same or even worse.

Another reason why these top ETFs do not always perform as well is the rebalancing period of the fund. All ETFs rebalance, but the more infrequent the rebalancing period is, the greater the risk of the fund buying stocks that it probably should not have. If a company goes on a positive run but shows worrying signs, the fund’s algorithm could still likely buy it based on the last four or six months of good returns. These funds mimic the momentum trading strategy, but at the cost of being passive, they bucket performance periods into arbitrary fixed periods.

Unfortunately, there might not be a better way for investors. An active strategy which can avoid these fixed rebalancing periods will run into the human problems all active investors face. The management fees will also increase, although this factor is not as material.

So what can investors do if they want to follow the momentum trading strategy but want a better chance of outperforming the market? A possible way would be to find a momentum trading ETF that switches its focus away from the top stocks in the market. For example, XMMO was the best-performing of the three ETFs listed, focusing only on middle-cap stocks in the Russell 1000.

The momentum-based strategy is often used to own a class of assets not correlated to the market, thus, diversifying a portfolio. Investors can go on the other end of the spectrum and own an ETF like DBMF, which looks to emulate the returns of hedge funds across a dozen or so asset classes. This strategy is truly uncorrelated to the market, but an investor would likely not understand all the derivatives and asset classes the fund uses. These funds will charge much more management fees but also charge a fee for the profits made, though much less than the typical 2 and 20.

An investor will have to decide what type of fund to invest in based on their risk approach and purpose for using the strategy.

For where an investor can expect these funds to go in the future, the answer is simple. The highly correlated ETFs will likely follow the market (roughly). The truly uncorrelated ETFs will be hard to predict, which is their purpose.

Very insightful article! Hats off to you guys!

Love it.